Top 6 financial guidelines for people in early 20s!

Financial Guidelines for people in early 20s: Here is how you can manage your finances?

Early 20s marks the end of your teenage or carefree attitude that you have carried till now. The time you hit 20 everyone starts expecting you to behave maturely. Anyway remember when you are in your twenties, you are building a strong foundation for your financial future. The choices that you make now will affect you as you move into your thirties and beyond. You can take the steps now to build a solid future for yourself and your family. These steps will help you to establish habits that will help you successfully manage your finances over the coming years. Here are financial guidelines for the people in early 20s, take a look.

So, here are following financial guidelines for you. Live your 20s freely with proper future planning.

1. Avoid using credit cards

It is one of the most important points that you should keep in mind. You should stop using your credit cards. It is too easy to get into credit card debt, and to find in a few years that you have managed to run up large amounts of debt. Take the time now to stop using your credit cards, even for emergencies. Credit card always brings major problems. Don’t get into a habit of using it. A budget and an emergency fund will help you to achieve your goals.

2. Start saving for your retirement

If you are wondering there is still a long way to go for your retirement and there is no need to save in your early 20s, then you are wrong. You need to start saving for retirement now. The sooner you start, the sooner you will be able to retire. You don’t have to wait for that ‘retirement age’. You just need to start saving from an early age and you will definitely enjoy your old period. Most importantly you don’t need to depend on anyone.

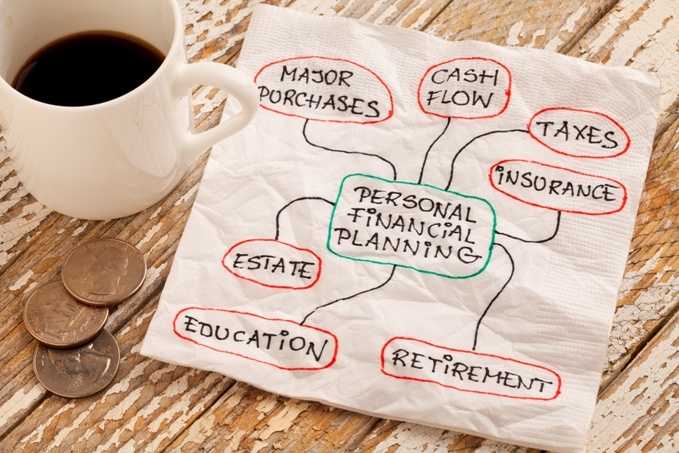

3. Create your own solid financial plan

In order to live an organised life, it’s important to rely on plans. You would never go on a trip without a solid destination in mind. It is important to have a solid financial plan so that you know where you are going to end up financially, and to help you identify the steps you need to take to get there. Your financial plan should include everything from buying a home to retirement. As you get married and have children, you will only need to adjust the plan. Do not put off creating a financial plan just because you are single. You still need to have specific savings and retirement goals that you are working toward. Include your life partner too on this saving agenda.

4. Save for a Down Payment on a House

Everybody has a dream of buying a house. As soon as you have pay off your credit card debt, you should start putting money aside to use as a down payment on a house. It does not need to be very much money while you are paying off your student loans, but after you do, you should try save enough to buy your first home in your late twenties or early thirties. A down payment makes it easier to qualify for a good interest rate. Saving now will help you be ready when it does come time to buy a home. Buying a house that too on your 20s is the biggest achievement.

5. Establish an emergency fund

Instead of using credit cards you can establish your own emergency fund.

Your emergency fund will give you peace of mind. It can help you deal with the unexpected things that life throws at you from your car breaking down to home repairs to losing a job. The larger your emergency fund, the safer you can feel. Your own savings or emergency fund always help you to come out of debt trap.

6. Budget Every Single Month

The most important step you can take in your twenties is, to begin with budgeting. You will need budget for every month and for the rest of your life. The sooner you start budgeting the better off you will be financially. Your budget gives you the ability to decide how you want to spend your money. Budgeting will always help you to save your money and you will automatically avoid overspending. Once you get married, you will need to budget with your spouse. It takes time and efforts, but if you are budgeting, you can be confident that you are handling your finances responsibly.