RBI Keeps Repo Rate Unchanged at 6.5% for Ninth Straight Meeting

The RBI's MPC keeps the repo rate at 6.5% for the ninth straight meeting, citing inflation concerns and maintaining its stance on "withdrawal of accommodation."

RBI Monetary Policy Meeting: MPC Decides to Maintain Repo Rate at 6.5% for Ninth Consecutive Meeting Amidst Rising Inflation and Economic Growth Forecast Adjustments

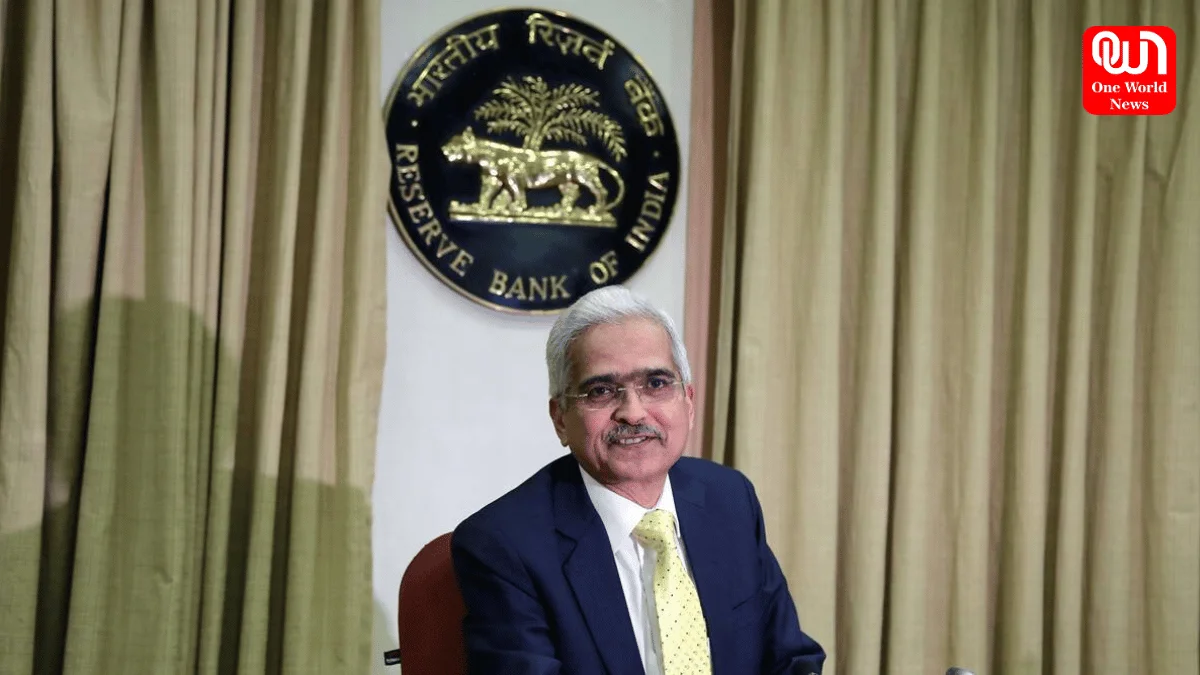

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) decided on Thursday to keep the repo rate unchanged at 6.5% for the ninth consecutive meeting. The decision was made with a 4-2 majority vote, maintaining the stance of “withdrawal of accommodation.”

As reported by Reuters, four out of six MPC members supported the decision. RBI Governor Shaktikanta Das emphasized the importance of price stability for sustained economic growth. He noted, “Headline inflation, after remaining steady at 4.8 per cent, climbed to 5.1 per cent in June. The expected moderation in inflation in Q2 due to base effects is likely to reverse in the third quarter… Ensuring price stability eventually leads to sustained growth.”

Read more: What Kangana said to Vinesh ? Read in top 5 news of the Day!

The economic growth forecast for India in FY25 remains unchanged at 7.2%. However, the forecast for the first quarter was adjusted to 7.1% from the earlier projection of 7.3%. Previously, the MPC had revised the growth forecast to 7.2% from 7%. For the next financial year’s first quarter, growth is projected at 7.2%.

Inflation projections for FY25 were retained at 4.5%. Quarterly forecasts were adjusted: Q2 at 4.4%, Q3 at 4.7%, and Q4 at 4.3%, compared to previous projections of Q2 at 3.8%, Q3 at 4.6%, and Q4 at 4.5%. The first quarter of the next financial year is projected at 4.4%.

Read more: Challenges India Faces in Granting Asylum to Sheikh Hasina

Governor Das highlighted the impact of food inflation, which holds a 46% weight in the headline inflation. He remarked that high food prices likely persisted in July, influencing the revision of the inflation forecast for Q2 of the current financial year.

We’re now on WhatsApp. Click to join

A poll conducted by ‘Business Standard’ revealed that 10 respondents expected the MPC to maintain the status quo. The last rate change by the MPC occurred in February 2023, raising the policy rate to 6.50%. In June, the annual retail inflation rate rose above 5% for the first time in five months, driven by a surge in food prices.

Like this post?

Register at One World News to never miss out on videos, celeb interviews, and best reads.

)