Working Capital Management

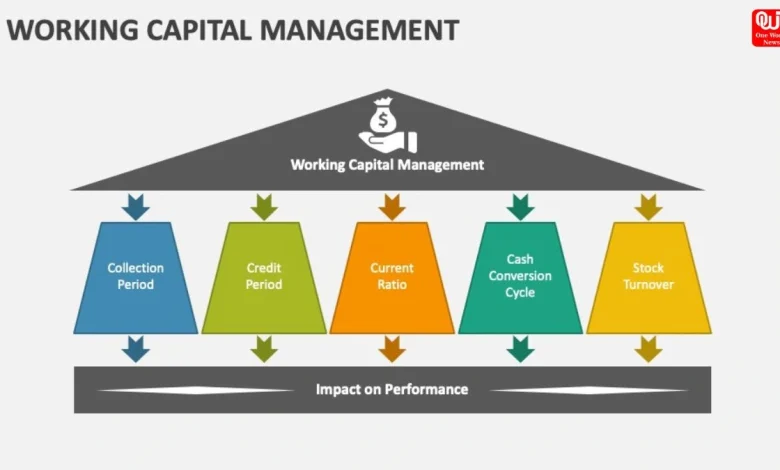

Working capital management means control over a firm's current assets- like cash, inventories, accounts receivable, etc, and control of current liabilities like payables and short-term debt.

Working Capital Management: Importance and Definition

Working capital management helps these assets and liabilities to get balanced or the same level so that all the current expenses and debt settlements of the firm fall into place without affecting the business and makes sure to maintain the availability of cash for any emergency requirements.

Below is the formula to calculate working capital:

Working Capital = Current Assets – Current Liabilities

Components of Working Capital Management:

Below are the components divided into 2 categories, i.e., current assets and current liabilities.

-

Current Assets

There are those short-term assets that are available with you and are ready to be used within a year. Some of them are:

- Cash and Cash Equivalents: In terms of cash in hand, or in the bank-in actual accounts, is the most liquid form of asset.

- Accounts Receivable: The total sum of money owed to the business by customers or vendors on credit for products and services offered to them.

- Inventory: Stock of raw materials, work-in-progress, and finished goods the company holds and which are ready to be sold.

- Marketable Securities: Short-term investments that can be relatively liquid and easily converted to cash.

-

Current Liabilities

Current liabilities are obligations that need to be liquidated within a year. Major components include:

- Accounts Payable: The sum total of the funds that the firm owes to its suppliers for either supplies of goods or services it has ordered on credit.

- Short-term Debt: Loans and other debt that must be repaid within 1 year by the owner of the business.

- Accrued Expenses: Expenses that have already been incurred but not paid yet, for example, salaries or wages to the workers and taxes to the government.

Pros of Effective Working Capital Management

-

Ensures Liquidity

Work capital management ensures that the business owner has enough cash available in his business to meet its short-term obligations-such as the suppliers’ bills or invoices, workers’ wages, etc.

-

Improves operations of the business

This can make businesses optimize their daily operations since it manages working capital. For example, by lowering the days to collect receivables or by negotiating even better credit terms with suppliers, a company can improve its cash flow position and ensure it has enough resources that keep operations running smoothly.

-

Reduces Borrowing Costs

A company will avoid short-term loans that are paid later through its interest accounts, thereby saving costs. This will save the company a lot of money since it avoids borrowing at a cost that directly reduces interest expenses and borrowing costs.

-

Facilitates Business Growth

Proper working capital will allow a firm to invest in new opportunities, expand its operations, and grow. A business, even a profitable one, may not be in an easy position to take hold of growth opportunities without proper management of working capital as they might not have the appropriate cash flow to finance their new projects or products. A working capital financing option is something many business owners seek when in deficiency.

-

Risk Mitigation

Good management of working capital in a business organization allows it to react to unexpected events like economic downturns, unexpected hikes in the cost of raw materials, or slowed customer payments. Therefore, the stability and continuity of a business are boosted.

Cons of Working Capital Management

Working capital management is important to run a successful business; however, it also has some limitations:

-

Time-Consuming

Working capital is managed effectively through regular monitoring of current assets and liabilities, which eats up time. The tracking of the information becomes difficult for small businesses with scarce resources as time and personnel have to be committed.

-

Cash Flow Forecasting:

It is difficult to predict cash flow with accuracy.

However, proper cash flow forecasting is something that always involves certain risks for working capital management. Changes in market conditions, customer habits, or other supply chain interruptions all directly and indirectly affect cash flow, thus affecting the cash flow projections and further management.

-

Short-term Focus

Working capital management focuses on short-term health, and the excessive usage of short-term liquidity might often lead to neglecting the investment in long-term scenarios. Companies so fixated on working capital management may not invest enough in long-term management for growth and sustainability.

-

The Balance Act

It is not always easy to balance current assets and current liabilities. Too much inventory ties up cash available for other forms of use, while too little inventory results in stockouts and missed sales.

Conclusion:

Effective management of working capital constitutes one very important key component that ensures the healthy functioning, liquidity, and long-term sustainability of any business especially for MSMEs. Apart from making it possible for businesses to meet immediate obligations, effective management of current assets and liabilities enhances operational efficiency, saves costs on borrowings, and increases opportunities for growth. However, it can restrict the effectiveness of these aspects by being time-consuming, in cash flow forecasting, and a short-term focus. Thus, in essence, there is a direct need for businesses to achieve a balance between short-term liquidity and long-term sustainability.

NBFCs assist MSMEs with easy access to flexible financial solutions with options like an instant business loan without needing collateral. Traditional banks put heavy collateral and credit requirements that are often hard for any MSME to seek business loans. NBFCs fill this gap by offering easier access to business loans with more customized offerings. The credit borrowing process with NBFC is favorable as it offers faster approval processes, easier terms, and customized repayment schedules. Which helps in making the right working capital management for MSMEs.

We’re now on WhatsApp. Click to join.

Like this post?

Register at One World News to never miss out on videos, celeb interviews, and best reads.